You must be signed in to read the rest of this article.

Registration on CDEWorld is free. Sign up today!

Forgot your password? Click Here!

The ADAA has an obligation to disseminate knowledge in the field of dentistry. Sponsorship of a continuing education program by the ADAA does not necessarily imply endorsement of a particular philosophy, product, or technique.

Dentistry is a business as well as a health care service profession. It is essential to provide treatment for patients in a caring manner, but it is also necessary to maintain maximum efficiency and production in order to maintain a successful practice. The administrative assistant plays a key role in the smooth operation of any dental practice. The administrative team of the 21st century is challenged with: new technology, federal and state mandates, patient needs, managed care, shortage of competent personnel, satellite offices, expanding group practices, redefinition of auxiliary utilization and credentialing and an ever-changing dental health care system. This financial management course focuses on how a dental practice protects information, receives monies for services rendered, and makes payments to outside entities. Upon completion of this course, the business assistant will be able to apply standard financial procedures to any dental practice.

HIPAA and Record Protection

The Health Insurance Portability and Accountability Act (HIPAA) was signed into law on August 21, 1996 with regulations to be implemented by 2002 in all areas of healthcare. HIPAA requires that the transactions of all patient healthcare information be designed in a standardized electronic style. In addition to protecting the privacy and security of patient information, HIPAA includes legislation on the formation of health savings accounts (HSA's), the authorization of a fraud and abuse control program, the easy transport of health insurance coverage, and the simplification of administrative terms and conditions.

HIPAA covers three key areas, and its privacy requirements can be broken down into three types: privacy standards, patients' rights, and administrative requirements.

Privacy Standards

A fundamental concern of HIPAA is the careful use and disclosure of protected health information (PHI). PHI is commonly electronically controlled health information that can be recognized individually, typically through the use of Social Security numbers or other individually designated identifiers. PHI also refers to verbal communication, although the HIPAA Privacy Rule is not intended to obstruct necessary verbal communication. The United States Department of Health and Human Services (USDHHS) does not require restructuring of the dental practice, such as soundproofing, architectural changes, and so forth, but some caution is necessary when exchanging health information by conversation.

An Acknowledgment of Receipt Notice of Privacy Practices, which allows patient information to be used or divulged for treatment, payment, or healthcare operations (TPO), should be obtained from each patient. The patient must sign a statement acknowledging receipt of the practice's written privacy policy and this acknowledgement is kept in the patient's record for a minimum of six years. A detailed and time sensitive authorization can also be issued, which allows the dentist to release information in special circumstances other than TPO's. A written consent is also an option. Dentists can disclose PHI without acknowledgment, consent, or authorization in very special situations such as any of the following:

| • | Fraud investigation |

| • | Law enforcement with valid permission (i.e., a warrant) |

| • | Perceived child abuse |

| • | Public health supervision |

When divulging PHI, a dentist must try to disclose only the minimum necessary information, to help safeguard the patient's information as much as possible. It is important that dental professionals adhere to HIPAA standards because healthcare providers (as well as healthcare clearinghouses and healthcare plans) who convey electronically formatted health information, via an outside billing service or merchants, are considered covered entities. Covered entities may be dealt serious civil and criminal penalties for violation of HIPAA legislation. Failure to comply with HIPAA privacy requirements may result in civil penalties of up to $100 per offense with an annual maximum of $25,000 for repeated failure to comply with the same requirement. Criminal penalties resulting from the illegal mishandling of private health information can range from $50,000 and/or 1 year in prison to $250,000 and/or 10 years in prison.

Patient Rights

HIPAA allows patients, authorized representatives, and parents of minors, as well as minors, to become more aware of the health information privacy to which they are entitled. If any health information is released for any reason other than TPO, the patient is entitled to an account of the transaction. Therefore, it is important for dentists to keep accurate records of such information and to provide those records when necessary.

The HIPAA Privacy Rule determines that the parents of a minor have access to their child's health information. This privilege may be overruled, for example, in cases where there is suspected child abuse or the parent consents to a term of confidentiality between the dentist and the minor. The parents' rights to access their child's PHI also may be restricted in situations when a legal entity, such as a court, intervenes and when a law does not require a parent's consent. For a full list of patient rights provided by HIPAA, be sure to acquire a copy of the law and to understand it well.

Administrative Requirements

Complying with HIPAA legislation may seem like a chore, but it does not need to be so. It is recommended that the administrative assistant become appropriately familiar with the law, organize the requirements into simpler tasks, begin compliance early, and document progress in compliance. An important first step is to evaluate the current information and practices of the dental office. Dentists will need to write a privacy policy for their office (a document for their patients detailing the office's practices concerning PHI). It is useful to try to understand the role of healthcare information for the practice's patients and the ways in which they deal with the information while they are visiting the office. Staff training is a must, ensuring that all staff members are familiar with the terms of HIPAA and the practice's privacy policy and related forms. HIPAA requires that a privacy officer be designated. A privacy officer is a person in the practice who is responsible for applying the new policies in the practice, fielding complaints, and making choices involving the minimum necessary requirements. Another person with the role of contact person will process complaints.

A Notice of Privacy Practices, a document detailing the patient's rights and the dental practice's obligations concerning PHI, also must be drawn up. Further, any role of a third party with access to PHI must be clearly documented. This third party is known as a business associate (BA) and is defined as any entity that, on behalf of the dentist, takes part in any activity that involves exposure of PHI.

A Business Associate (BA) is a person or entity that, on your behalf, performs or assists in the performance of a function or activity involving the use or disclosure of PHI.

Examples of Business Associates:

| • | Attorney |

| • | Accountant |

| • | Business consultant |

| • | Dental and/or medical laboratories |

| • | Billing service |

| • | Answering service |

| • | Computer support staff |

| • | Others who have access to use or disclose PHI as part of their responsibilities to you |

The following are not considered to be Business Associates: a member of the staff such as an employed dental associate, assistant, receptionist or hygienist; the U.S. Postal Service, or a janitorial service.

HIPAA Security

The Security Rule defines highly detailed standards for the integrity, accessibility, and confidentiality of electronic protected health information (EPHI) and addresses both external and internal security issues.

Entities covered by HIPAA are required to:

| • | Assess potential risks and vulnerabilities |

| • | Protect against threats to information security or integrity, and guard against unauthorized use or disclosure of information |

| • | Implement and maintain security measures that are appropriate to their needs, capabilities, and conditions |

| • | Ensure entire staff compliance with these safe guards |

The standard is broken into three separate parts:

Administrative Safeguards - This segment, which makes up half of the complete standard, limits access to information to proper individuals only and shields information from all others. It must include documented policies and procedures for daily operations, address the conduct and access of workforce members to EPHI, and describe the selection, development, and use of security controls in the workplace.

Physical Safeguards - Physical safeguards prevent unauthorized individuals from gaining access to EPHI via computerized systems and the Internet.

Technical Safeguards - This section includes using technology to protect and control access to EPHI. Computers are now a fundamental part of most dental practices. Electronic communications for patient-care purposes must meet the standards of HIPAA. Confidentiality remains a prime concern, and certain measures must be taken to ensure that patient information is neither shared nor accessible to unofficial parties. Also, the authenticity of the original record must be maintained with electronic transmissions. It is important to make sure dental software packages contain features that address both confidentiality and the integrity of the original records. When choosing a computerized charting program, the inability to change records must be considered. Once an entry is made, the only way to modify that entry should be to amend it in the form of an addition; once entered, an existing entry should be inalterable.

Accounts Receivable

The accounts receivable in a dental practice is all monies owed to the practice. Accounts receivable management, commonly referred to as bookkeeping, involves maintaining financial records for all transactions related to collecting fees for services rendered to the patients. With the high cost of materials and equipment, practice profit management is important. Information must be arranged so that it is always current, precise, and provides the information needed to efficiently manage financial matters.

The dentist may obtain bonding insurance on team members whose primary responsibility is to handle the practice monies through receiving, banking patient payments and writing disbursements. While this insurance will cover a loss of money, the team member can be still be prosecuted under the laws of a given state for any theft of funds.

Financial Records Organization

Many dental financial records will be kept for a minimum of seven years, and most dental practices keep them indefinitely. Financial information should not be kept in the patient's clinical chart. Ledger cards, insurance benefit breakdowns, insurance claims, and payment vouchers are not part of the patient's clinical record and should not be included in, or on the front cover of, their record. If such information must be filed, keep it under a separate cover in a different location of the practice.

A great benefit to computerized dental software is the organization it provides for these records. Once correctly entered, the information remains intact and saved with each back up. Depending on the software chosen, windows or tabs can be opened to access different information quickly and efficiently.

Basics of Accounts Receivable

The accounting process begins when the patient leaves the treatment area. Fees charged for services provided are done so according to a fee schedule, defining what patients are charged for each particular service. The fee schedule is referred to as the usual, reasonable and customary fee. The usual fee refers to the fee typically charged by the dentist for a specific treatment procedure. The reasonable fee is the midrange of fees charged for the same procedure; if the case was particularly difficult, then the usual fee may be raised to reflect the degree of difficulty. The customary fee is the average, up to the ninetieth percentile, that dentists in the area charge for the same procedure. This type of fee schedule allows for some flexibility on the part of the dental practice. If he or she wishes to charge more for a particular procedure, the insurance companies utilizing "fee-for service plans" will not pay above the usual, reasonable and customary fee schedule. Patients are then billed for any charges not covered by the insurance company and may become upset if fees were not previously discussed in the treatment plan or at the consultation appointment. Most dentists choose to stay within the fee schedule range. This range can be adjusted yearly, if need be, by raising fees three to five percent for area dentists, in order to cover the rising costs of dentistry.

Dentists, on occasion, offer courtesy adjustments to their charged fees. A professional courtesy is offered to other dental professionals, dental team members, family and friends. Additionally, a courtesy adjustment may be made to patients paying in full on the day of service, or by offering a senior discount to older patients. The dentist has the discretion to make any adjustments to fee requests. Careful consideration must be used when a dentist chooses to offer a discount as this can be seen as "changing fixed fees" and viewed as a form of discrimination. Each practice should consult their state's Dental Practice Act and the ADA Code of Ethics on Fraudulent Behaviors.

Another area that impacts many dental practices, in which dentists make adjustments, is dental insurance. Dentists who accept assignments in specific insurance programs agree to accept a payment in full by the provider. If a dentist treats a patient on a particular program with whom he or she is participating, and the insurance company reimburses at $80 for treatment that was billed at $100, the dentist must write off or adjust the remaining $20. The patient is not responsible for the remaining $20 because the dentist is a provider for that particular insurance plan. The dental team must be made aware that a practice cannot survive if the dentist was a participating provider for all insurance companies. The adjustments would quickly outweigh profitability. Dental insurance is covered more thoroughly under third party payments.

Charge Slips/Routing Slips. In dental practices that are not paperless, each patient will have a charge slip (or routing slip) that details certain information. On this form, the patient's personal information is located, along with insurance information, current balance, any past due balance and an area for the clinical team to list services rendered for the patient that day. Most slips will also have an area for noting any additional appointments.

The completed charge slip is returned to the administrative team for posting of charges to the accounts receivable system. At the end of the day, the total on the charge slips are matched against the amounts entered into the computer system. In paperless practices, this data is entered into the computer system, in the treatment area, by one of the clinical team members.

Creating Financial Arrangements. Many individuals live within monthly budgets for household and personal expenses. When a dental emergency arises, or a large treatment plan is needed, some dental practices create financial arrangements with their patients to assist them with financing their treatment. Expensive treatment options such as a crown, bridgework, dentures, orthodontics or a root canal can severely impact a patient's finances especially if the entire amount must be paid in full at the time of service.

Financial arrangements are made when fees are presented, usually at the time of the treatment plan and case presentation. For patients with a well-established history with the dental practice, arrangements are typically made quickly. For new patients, or patients with a history of slow payment, a credit report may be warranted (with the patient's consent) before a determination is made to offer a financial plan. Also, most dental practices accept credit cards for payment.

Patients who have a poor credit history may be steered to an outside agency offering low interest loans for dental treatment. Agencies vary from state to state, but are available to dental patients. With outside financing, the dental practice is not involved in the financial arrangements. The patient receives a loan for dental treatment, the dental office is paid in full, and the patient makes payments to the lending agency.

When financial arrangements are made, the total amount of treatment is divided by a specified number of months. Some practices offer six months interest free, and on day 181, the interest will begin accruing on any remaining amount. Other practices allow patients up to three months interest free. It is up to the discretion of the dentist to offer different terms in special circumstances. After the patient has accepted the proposed treatment, the administrative team member may be asked to work with the patient to develop a payment plan amenable to both the patient and the dental practice. When financial arrangements are developed, the following information should be considered:

| • | Total fee for services to be rendered |

| • | Balance, after deduction of a down payment, which is the amount that is financed |

| • | Annual percentage rate of the finance charge - if there is one |

| • | Number of payments to be made |

| • | Amount of each payment |

| • | Date on which each payment is due |

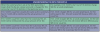

Once this information has been determined, the financial agreement is completed (Figure 1) and the patient and the dentist each signs the contract. A copy is given to the patient and the original is retained by the practice in the administrative area. For dental practices with computerized systems, a note is often placed on the patient's account within the system.

Some software systems allow the user to change default parameters such as the statement date and the finance charge accruement.

Maintaining Financial Arrangements. Some dental practices may delegate the maintenance of financial arrangements to the practice administrator or one of the administrative team members. Depending on the number of arrangements made within the practice, there are several methods of tracking payment dates. For practices that are not computerized, a large calendar can be used to write the patient's name on the date payments are due. Computer software also has calendar and tracking capabilities. Other software allows the administrative team members to print a monthly statement of patient payments that are due.

If a patient's payment does not arrive by the designated date, most dental practices allow 5-7 days before contacting the patient. For patients with a good payment history, the delay may be slow mail delivery or the payment was sent a day or two late. Conscientious patients will call if their payment is going to be late. For patients who have a slower payment history, a courtesy call is often made to remind the patient of this financial obligation. If the team member reaches the patient via telephone, an offer to place the charge on the patient's credit card ensures the dental practice of prompt payment of the outstanding bill.

There are different options to utilize credit card payments. Some patients will call on the due date with their credit card information, while others will authorize the dental practice to charge the specified amount on the monthly due date.

Maintenance of Account Records

Maintenance of patient account records is vital to the profitability and success of the dental practice. It is crucial that amounts owed to the dental practice be collected in a timely and organized manner.

For offices that do not utilize a computer, this maintenance is completed with paper receipts, ledger cards, and a pegboard system. A pegboard system utilizes specially coordinating papers that are backed with a no-copy-required, or NCR, film. When stacked properly upon each other, the papers require the writer to only inscribe the transaction one time to produce a daily journal record, ledger card record for billing, and patient receipt or walk-out statement.

The daily journal page is the practice record of all transactions for patients seen each day the practice is open for business. The journal page includes the patient's name, any charges, payments and adjustments to the account. As each patient concludes an appointment, postings are made into the system for each individual patient. If the office operates a computer, the column totals of the daily journal page are automatically figured and are used to generate other practice reports.

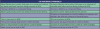

Receipt and walkout statements are frequently generated throughout the day. When a patient pays for a service or makes a payment on the account, a receipt is given for the patient's records. A walk-out statement (Figure 2) is similar to a receipt; however, it lists the charges for the day and balance totals for the account. Walk-out statements are sometimes requested by those patients who do not pay at the time of service. Typically, this type of statement is provided with a return envelope, sometimes with prepaid postage. Walk-out statements are also given to patients with outstanding balances, as a reminder that money is owed on the account. The regular use of walk-out statements improves a practice's cash flow as payments are often received more quickly. The use of walk-out statements also reduces the number of statements that need to be prepared at the end of the month.

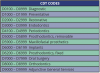

Day-End Activities. The daily journal page, also known as a day sheet (Figure 3), is often used in the day-end activities of the administrative team. One member may be responsible for making sure that the bookkeeping system balances. Errors are found at times, and frequently the term GIGO is used: garbage in, garbage out, meaning that the output will only be as good or as accurate as the information entered into the system.

Activities completed at the end of the day ensure that all the data is accurate before transactions are input into the bookkeeping system the following day. Receipts must match bookkeeping balances with charges posted to the correct patient and correct provider furnishing the service. Any adjustments must also be properly documented. Each dental practice will differ in its protocol concerning end of the day activities.

Preparation of Daily Bank Deposit. All financial receipts of the dental practice should be deposited daily. When the amount of the receipts for a given day matches the amount of the deposits, bookkeeping accuracy has been achieved. A deposit slip is an itemized accounting of the currency and checks taken to the bank to be credited to the dental practice's account. This deposit slip can be generated from a computer after all checks have been posted to the patient accounts. After the amount has been deposited in the practice account, the date and the amount of deposit should be entered in the practice check register.

Bank Deposit Slip:

| • | All cash (paper and coins) is listed under currency. |

| • | Checks are listed separately on the deposit slip by the last name and the first initial of the person issuing the check. Computer systems do this automatically. Some financial institutions do not require the listing of individual checks, but instead will accept a calculator printing of the amounts entered on the checks and at the very end listing the number of checks. |

| • | Some dental practices will prepare the deposit slip in duplicate so one will be on record with the practice's financial records. |

| • | All checks must be endorsed on the back of the check with the practice's deposit stamp. |

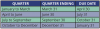

Account Statements. Generation of account statements (Figure 4) will vary from practice to practice depending on the parameters set within the software program. Some practices generate a patient statement ten days following the posting of charges. Other practices wait a full thirty days before generating a statement. A statement will not generate if there is an insurance payment pending. The benefits of sending statements less than thirty days include a lesser amount of statements being generated on a given day. For patients that have not been in and have an outstanding balance, their statements are still generated monthly until the balance is zero. For the practices that do all statements monthly, many will break the alphabet into thirds and do cycle billing for each third of the alphabet. The beginning of the alphabet is generated in the first third of the month, the middle in the middle third of the month and the last third at the end of the month. When an insurance payment is received and the entire balance is not reimbursed, a statement is sent to the patient for the remaining portion, unless the dentist is a participating provider and the amount is adjusted.

A statement should not be generated if an insurance payment is pending. However, if the account is expecting several insurance payments, statements may be generated and sent at the assigned time to reflect the patient's portion due-to-date.

Finance charges that accrue on unpaid balances will go into effect at the agreed time. Some dental practices allow a thirty-day grace period, while others allow a ninety-day grace period. It is the decision of the dentist as this directly affects the profit margin. Another factor the dentist should consider is the size of the patient database.

Month-End Activities. The accounts receivable report (Figure 5) is a valuable management tool. This report shows the total balance due on each account plus the report provides an analysis on the age of the account. Accounts are aged as follows:

| • | Current - recent charges not yet billed to the patient |

| • | 30 days old |

| • | 31 to 60 days old |

| • | 61 to 90 days old |

| • | Over 91 days |

Information provided in this report is helpful in tracking accounts and notifies the assistant which accounts are overdue. The computer can automatically generate this report with a breakdown of the account age. For dental practices that do not use a computer system for bookkeeping, it is possible to generate a manual aged account report.

Delinquent Accounts. Accounts, at times, will become delinquent. It is important that all efforts to collect delinquent payments from patients be done with tact and within the dental practice's policies regarding this matter. Ultimately, the dentist is responsible for the actions of her or his employees and does not want to lose a patient who has fallen on hard times to an overly aggressive employee. Under the Fair Debt Collections Act, it is illegal for anyone to do the following when attempting to collect a debt:

| • | Telephone the delinquent individual before 8 am or after 9 pm |

| • | Use obscene language or threaten violence |

| • | Use false pretenses to obtain information |

| • | Contact the delinquent individual's employer, except to verify employment or residence |

Most dental practices will attempt to contact the delinquent patient by phone or by mail prior to turning over the individual to a collection agency. All attempts at collecting monies owed by mail should be phrased in a positive, but firm manner. Business-like terms should be used to make every effort in persuading the patient to pay the debt, to assist in the payment of the debt and to allow the patient to avoid further embarrassment while doing so. Collection letters should be individualized to suit the situation, with early letters designed to act as mere reminders of a debt "forgotten." The patient should always be given the benefit of the doubt that intentions were good to pay, until lack of response over a period of time proves differently. When sending letters of any sort, reference to debt collection may not be placed on the outside of the envelope, as this is an invasion of privacy.

The longer a practice puts off collection on accounts, the more difficult it will be to collect on the debt and the chances of receiving the debt diminish. Severely delinquent accounts are often turned over to an outside collection agency. These agencies will normally charge one third of the balance collected as its fee. All accounts that are turned over to a collection agency are reported to the credit bureau. Many patients do not realize that neglectful repayment habits will affect other areas of their personal lives because of the reporting to the credit bureaus. After debt is collected by the collection agency, the fees are subtracted and the balance is sent to the practice. The practice will then write off any remaining balance as bad debt.

Debt Collection Timetable:

| • | 30 Days - Regular statement sent 30 days after treatment, on completion of treatment with financial arrangements printed on statement. |

| • | 60 Days - Second statement with a printed collection message or a telephone call. |

| • | 75 Days - Telephone call with a cordial collection letter. |

| • | 90 Days - Third statement with a stronger worded collection message stating unless payment is received in ten days, the account will be turned over to a collection agency for action. |

| • | 105 Days - Telephone call stating unless account is paid in full, it will be turned over to a collection agency for action. |

| • | 120 Days - If no payment has been made and promises not kept, the account is referred to a collection agency for debt repayment. |

There are special circumstances that affect a dental practice's collection efforts:

| • | Bankruptcy - when a patient declares bankruptcy, the dental practice is notified and all attempts at collecting debt must be stopped. The practice is no longer able to send statements or to contact the patient by phone regarding the amount owed. Any balance remaining is written off as a loss to the practice as bad debt. |

| • | When a patient dies and finances are held up in probate, a person is typically designated to execute the deceased individual's estate and oversee any payments of outstanding bills. Monthly statements should be addressed to the individual as "To the Estate of Abigail Jones" until paid in full. |

| • | It happens infrequently, but patients can "skip" town without leaving a forwarding address. Statements mailed by the practice will be returned with "no forwarding address" on the outside of the unopened envelope. The address should be verified to make sure it is correct; if so, the practice has three choices: |

| 1. | Pursue the unpaid debt |

| 2. | Turn the patient over to a collection agency |

| 3. | Write off the remaining balance as "bad debt," resulting as a loss for the practice. |

Management Reports. A variety of management reports can be prepared from most computerized software systems.

Examples of these reports include:

| • | Aging account balances - patient accounts with a balance remaining on the account. |

| • | Pending insurance payments - insurance claims waiting to be received and posted to the patient accounts. If a long period of time has passed, a call to the insurance company can verify if the claim was received for processing. |

| • | Pending treatment plans - treatment plans sent for predetermination to the insurance companies, but not yet accepted by the patient. |

| • | Unscheduled preventative appointments - patients who need restorative appointments. |

| • | Unscheduled recare appointments - patients not yet contacted or who have not scheduled recare appointments. |

| • | Unscheduled pending page appointments - patients who have broken or cancelled appointments and have not yet rescheduled. |

There are many other management reports that may be generated for marketing purposes, such as:

| • | Patient demographics - reports based on age or zip code. |

| • | Treatment class production goals - how much was produced in a specific fee code for the month; e.g., amount produced for whitening procedures. |

| • | Production amount based by provider - amounts produced can be tracked by department (doctors, hygiene, assisting), or by the individual team members. |

What dental practices do with these different management reports varies greatly from location and type of practice and depends on the dentist's motivation in marketing practices.

Third Party Carriers

The effective management of patient accounts is another critical element of a smooth running dental practice. The dentist must institute understandable financial policies that will guide the administrative team in managing patient accounts and inquiries. The administrative team must first gather financial information from the patient. After the dentist presents the treatment plan to the patient, the administrative assistant presents the fee information. The fees are derived from the dentist's fee schedule, which describes the fees for all the procedures that are performed in the office.

Once the fee has been presented, the administrative team member makes financial arrangements with the patient based on the office's policies and the patient's financial status. Financial arrangements are always made prior to the initiation of treatment. In many cases, the patient has some form of dental insurance that will reduce the cost of the dental treatment. The dental insurance typically does not cover the entire fee, and as a result the patient is responsible for the balance of the fee. The patient must pay this portion according to the previously arranged financial arrangements. With so many changes in healthcare and reimbursement schedules, it is crucial for the practice administrator to be current on plan policies and procedures.

Dental insurance is intended to increase access to dental care by reducing the cost to the patient. Nevertheless, dental insurance is usually not designed to pay the entire cost of the treatment and in most situations, the patient remains responsible for payment of a portion of the dentist's fee.

Fees and Third Party Payments

Insurance reimbursements can account for a large portion of the dental practice income. Therefore, the administrative assistant must be able to file claims in an accurate and timely manner, and follow up on claims as needed. Since the patient and the insurance carrier share costs, it is important to see that fees are charged and collected properly from the appropriate party.

When a patient has dental insurance, there are four parties involved: the subscriber, or insured, which may or may not be the patient. The second party involved is the group, often an organized group such as a union. This group is generally represented by a negotiating team, which has a broad background in benefits bargaining. The team is eager to obtain high quality dental care at minimal additional cost to its members. As a result, the employer agrees to purchase a dental insurance package from a carrier as a benefit for employees. The third party is the carrier, or the insurance institution, which has the primary role of distributing the dollars to the provider, the dentist, for services rendered to one of its subscribers, the patient. The amount of money the carrier pays depends upon the type of coverage purchased by the group. The dentist, who becomes the provider of dental service, is the fourth party in the insurance puzzle. The dental team must seek to perform the highest quality professional care, maintaining ethical standards at all times.

Dental insurance can be a mystery to many dental patients and not all patients are aware of the extent of their coverage or possible limitations. The patient must realize that when a treatment plan is accepted, he or she has also accepted the financial responsibility for that plan, even though it may not be covered in full by the carrier. Most groups inform their members through informational pamphlets, but often these are interpreted incorrectly by patients and thus, the administrative team member must be able to explain the benefits to the uninformed patient.

There are many variations in insurance plans, and the administrative team member should be certain to inform the patient of the benefits and the limitations of his/her plan. It is also important to understand how these different methods of payment influence the amount of payment the dentist will receive from the insurance carrier. There are many different ways in which dental plans reimburse for patient care.

Fee-for-Service. Under the fee-for-service system, the dentist is paid on the basis of services actually rendered. A major difference in these fee-for-service programs is the method in which payment is determined. The three most frequently used techniques of calculating prepaid, or fee-for-service, dental insurance benefits include: usual, customary, and reasonable (UCR) fees, schedule of benefits, and fixed fee schedule.

Usual, Customary, and Reasonable Fees (UCR). Insurance payment for covered benefits is based on a combination of usual, customary, and reasonable fee criteria. With this plan, the dentist is reimbursed for the services rendered based on usual, customary, and reasonable fees as it relates to that of other dentists in a given geographical area. The usual fee is the fee usually charged by the dentist for a particular procedure to private patients. The dentist must file his/her fees with the insurance company ahead of time and they are reflected in the carrier's records as the dentist's fee profile. The customary fee for a given service is set by the insurance carrier. The carrier sets the customary fee at a percentile of the usual fees charged by dentists with similar training and experience within the same geographic area. (See Table 1, Understanding the 90th Percentile)

A reasonable fee is one that is usual and customary, or it is justified because of a special circumstance. For example, the dentist may increase the usual fee for a particular procedure if there were difficulties with the case, or if treatment was extensive or complex (such as, during the course of treatment, a simple extraction becomes a surgical extraction).

In a UCR plan, the payment can still be low and the patient is often responsible for the difference between the insurance payment and the dentist's fee. The limitation of the plan also influences the amount that the dentist receives from the insurance carrier and how much the patient must pay.

Schedule of Benefits. This plan is also referred to as a table of allowances. The schedule of benefits is a list determined by the insurance company that stipulates the amount of the benefit the insurance company will pay for particular procedures. Typically, the patient must pay the difference between what the schedule of benefits allows for the procedure and the dentist's actual fee; however, the amount the patient actually pays will also be influenced by other factors in the patient's plan. In addition to these common types of programs, there are alternative payment plans discussed in the next section.

Fixed Fee. With this type of plan, the insurer gives the dentist a fixed fee schedule for particular procedures. This determines the amount of benefits received by the dentist, and the dentist accepts this amount as full payment. The patient cannot be billed for the remainder of the fee. Fixed fee plans are usually federally supported, such as Medicaid and Medical Assistance and can vary from state to state.

Alternative Plans. There are a number of alternative insurance payment plans and programs. They include the following:

| • | Capitation programs - In a capitation program the dentist has contracted to provide most, if not all dental services covered under the program to subscribers in return for payment on a per capita basis, not for services rendered. As a substitute, the contracting dentist receives a fixed rate per covered member regardless of the services provided. These capitation plans are commonly used in health maintenance organizations (HMO) and dental maintenance organizations (DMO). In these types of organizations, the dentists are employed by the HMO or DMO and provide dental care. Another alternative to HMO's and DMO's is to have the dentist contract with the organizations but maintain private practice. In both types of circumstances, the subscriber's options are restricted to those dentists who are under contract with the HMO or DMO. |

| • | Direct reimbursement plans - Direct reimbursement plans are a self-funding program in which the patient is reimbursed by his or her employer on the basis of a percentage of dollars spent for dental care provided. Under this type of plan, patients are able to seek dental care from the provider of their choice because no insurance carrier is involved. When dental care is sought, the patient pays for the treatment and then is reimbursed for a portion of the expense. The extent of reimbursement depends on the plan designed by the employer. |

| • | Health savings/health reimbursement accounts- Many employers offer a health savings account (HSA) or a health reimbursement account (HRA) as a benefit to their employee packages. These accounts are alternatives in managing the increasing costs of dental and medical care. HSA's allow the patient to save a specified dollar amount from each payroll check throughout the year and submit health-related expenses for reimbursement. HRA's are similar to direct reimbursement plans. |

| • | Point of service plans - are plans in which the benefit carrier reimbursement levels are determined by the participation status of the dentist rendering the dental treatment. |

| • | Open panel systems - are plans in which any licensed dentist may participate, enrollees may receive dental treatment from any licensed dentist, and benefits may be payable to either the enrollee or the dentist. The dental provider may accept or refuse any enrollee under this system. |

| • | Closed plan systems - are plans in which enrollees can only receive benefits when dentists who have signed an agreement with the benefit plan provide services. Dental providers then provide treatment to eligible patients. |

| • | Individual (Independent) Practice Associations (IPA) - a type of HMO. An IPA is an organization formed by groups of dentists for the primary purpose of collectively entering into contracts (with employers) to provide dental services to the enrolled populations (usually employees). These services are frequently provided on a capitation basis. These dentists may choose to practice individually or work together in a large group practice. In addition to treating patients enrolled in the IPA, care may be provided to individuals not covered by the contract, but as a traditional fee for service plan. |

| • | Preferred Provider Organizations (PPO) - a plan in which a participating dentist agrees to accept discounted fees for covered services rendered to plan enrollees. This is a variation of fee for service. Many dental providers may join a PPO as a marketing tool to attract new patients, or in an effort to retain current patients who are covered by the PPO plan. Patients who are not under the PPO plan are charged the dentist's usual fees. Patients may select their own dentist, however, they have the incentive to select the "preferred providers" because a larger portion of the costs will be covered under the contract. |

| • | Exclusive Provider Organizations (EPO) - a plan in which benefits are provided only if dental care is provided by institutional and professional providers with whom the plan contracts. There may be some exceptions allowed for emergency and out of the area care. |

Government Programs. Title XIX of the Social Security Act is a Federal/State entitlement program that pays for medical assistance for certain individuals with low incomes and few resources. The program is known as Medicaid and became law in 1965 as a cooperative venture jointly funded by the federal and state governments to assist states in furnishing basic care to needy persons. Medicaid is the largest source of funding for medical and health-related services for America's poorest of the poor. Within broad national guidelines established by federal statutes, regulations, and policies, each state:

| 1. | Establishes its own eligibility standards; |

| 2. | Determines the type, amount, duration, and scope of services; |

| 3. | Sets the rate of payment for services; and |

| 4. | Administers its own program. |

Medicaid policies for eligibility, services, and payment are intricate and vary considerably, even among states of similar size or geographic proximity. As a result, a person who is eligible for Medicaid in one state may not be eligible in another state, and the services provided by one state may differ considerably in amount, duration, or scope from services provided in a similar or neighboring state. Additionally, state legislatures may make changes to Medicaid eligibility, services, or reimbursement during the year.

Medicaid does not provide medical assistance for all poor individuals. Under the broadest provisions of the federal statute, Medicaid does not provide health care services, even for very poor persons, unless they are in one of the following groups. Individuals are generally eligible for Medicaid if they meet the requirements for the Aid to Families with Dependent Children (AFDC) program that were in effect in their state on July 16, 1996.

Medicaid Guidelines:

| • | Children under 6 years of age whose family income is at or below 133 percent of the federal poverty level (FPL). |

| • | Pregnant women whose family income is below 133 percent of the FPL (services to these women are limited). |

| • | Supplemental Security Income (SSI) recipients in most states (some states use more restrictive Medicaid eligibility requirements that pre-date SSI). |

| • | Recipients of adoption or foster care assistance under Title IV of the Social Security Act. Special protected groups (typically individuals who lose their cash assistance due to earnings from work or from increased Social Security benefits, but who may keep Medicaid for a period of time). |

| • | All children born after September 30, 1983, who are under age 19, in families with incomes at or below the FPL. |

Low income is only one test for Medicaid eligibility for those within these groups; their resources also are tested against threshold levels as determined by each state within federal guidelines. States generally have broad discretion in determining which groups of individuals their Medicaid programs will cover and the financial criteria for Medicaid eligibility. To be eligible for federal funds, however, states are required to provide Medicaid coverage for certain types of individuals who receive federally assisted income-maintenance payments, as well as for related groups not receiving cash payments. Besides Medicaid programs, most states have additional "state-only" programs to provide medical assistance for specified poor persons who do not qualify for Medicaid. Federal funds are not provided for state only programs. The following enumerates the mandatory Medicaid "categorically needy" eligibility groups for which federal matching funds are provided:

| • | Infants up to age 1 and pregnant women not covered under the mandatory rules whose family income is no more than 185 percent of the FPL (the percentage amount is set by each state). |

| • | Children under age 21 who meet criteria more liberal than the AFDC income and resources requirements that were in effect in their state on July 16, 1996. |

| • | Institutionalized individuals eligible under a "special income level" (the amount is set by each state-up to 300 percent of the SSI Federal benefit rate). |

| • | Individuals who would be eligible if institutionalized, but who are receiving care under home and community-based services (HCBS) waivers. |

| • | Certain aged, blind, or disabled adults who have incomes above those requiring mandatory coverage, but below the FPL. |

| • | Recipients of state supplementary income payments. |

| • | Certain working-and-disabled persons with family income less than 250 percent of the FPL who would qualify for SSI if they did not work. |

| • | TB-infected persons who would be financially eligible for Medicaid at the SSI income level if they were within a Medicaid-covered category (however, coverage is limited to TB-related ambulatory services and TB drugs). |

| • | Certain uninsured or low-income women who are screened for breast or cervical cancer through a program administered by the Centers for Disease Control. The Breast and Cervical Cancer Prevention and Treatment Act of 2000 (Public Law 106-354) provides these women with medical assistance and follow-up diagnostic services through Medicaid. |

| • | "Optional targeted low-income children" included within the State Children's Health Insurance Program (SCHIP) established by the Balanced Budget Act (BBA) of 1997 (Public Law 105-33). |

| • | "Medically needy" persons. The medically needy option allows states to extend Medicaid eligibility to additional persons. These persons would be eligible for Medicaid under one of the mandatory or optional groups, except that their income and/or resources are above the eligibility level set by their state. Persons may qualify immediately or may "spend down" by incurring medical expenses that reduce their income to or below their state's medically needy income level. |

Medicaid does not provide medical assistance for all people with limited incomes and resources. Even under the broadest provisions of the federal statute (except for emergency services for certain persons), the Medicaid program does not provide health care services for everyone. An individual must qualify for Medicaid. Low-income is only one test for Medicaid eligibility; assets and resources are also tested against established thresholds. Categorically needy persons who are eligible for Medicaid may or may not also receive cash assistance from the Temporary Assistance for Needy Families (TANF) program or from the Supplemental Security Income (SSI) program. Medically needy persons who would be categorically eligible except for income or assets may become eligible for Medicaid solely because of excessive medical expenses.

Dental services under Title XIX of the Social Security Act, the Medicaid program, are an optional service for the adult population, individuals age 21 and older. However, dental services are a required service for most Medicaid-eligible individuals under the age of 21, as a required component of the Early and Periodic Screening, Diagnostic and Treatment (EPSDT) benefit.

EPSDT is Medicaid's comprehensive child health program. The main focus of the program is on prevention, early diagnosis and treatment of medical conditions. EPSDT is a mandatory service required to be provided under a state's Medicaid program. Dental services must be provided at intervals that meet reasonable standards of dental practice, as determined by the state after consultation with recognized dental organizations involved in child health, and at such other intervals, as indicated by medical necessity, to determine the existence of a suspected illness or condition. Services must include at a minimum, relief of pain and infections, restoration of teeth and maintenance of dental health. Dental services may not be limited to emergency services for EPSDT recipients. Oral screening may be part of a physical exam but does not substitute for a dental examination performed by a dentist as a result of a direct referral to a dentist. A direct dental referral is required for every child in accordance with the periodicity schedule set by the state. The Centers for Medicare & Medicaid Services do not further define what specific dental services must be provided, however, EPSDT requires that all services coverable under the Medicaid program must be provided to EPSDT recipients if determined to be medically necessary. Under the Medicaid program, the state determines medical necessity. If a condition requiring treatment is discovered during a screening, the state must provide the necessary services to treat that condition, whether or not such services are included in the state's Medicaid plan.

States may elect to provide dental services to their adult Medicaid-eligible population, or elect not to provide dental services at all, as part of its Medicaid program. While most states provide at least emergency dental services for adults, less than half of the states provide comprehensive dental care. There are no minimum requirements for adult dental coverage.

Coverage may start retroactive to any or all of the three months prior to application if the individual would have been eligible during the retroactive period. Coverage generally stops at the end of the month in which a person's circumstances change. Most states have additional "state-only" programs to provide medical assistance for specified people with limited incomes and resources who do not qualify for the Medicaid program. No federal funds are provided for state-only programs. Payment is based on a schedule of benefits and the dentist must accept the amount paid by the carrier as payment in full. The dental practice may not bill the patient for the difference between the usual fee and the amount that Medicaid has paid.

Because Medicaid programs are managed differently from one state to another, policies and regulations governing covered dental services vary. Most Medicaid programs have the following general guidelines:

| • | The dentist agrees to accept the amount paid by the state or any other carrier designated by the state as payment in full; there is no patient copayment. |

| • | Any other third-party payer is always the primary carrier. |

| • | Reimbursement to the state is required if the patient or dentist receives payment from another third party source. |

| • | Records must be retained for a specified length of time (usually 7 to 10 years) and may be reviewed by an authorized state or federal official. |

| • | Patients with Medicaid coverage may not be discriminated against for reasons of race, gender, color, faith, or financial status. |

| • | Reimbursement is made only to dentists participating in the Medicaid program. |

| • | All claims must be submitted within 12 months of the date of service. |

| • | Prior authorization is required for certain treatments as outlined by the state. |

| • | All patient records remain confidential. |

| • | Handwritten forms are not accepted and must be typewritten, computer generated or submitted electronically. |

| • | In some states the Medical Services Administration has contracted with Delta Dental or other carriers to partially administer dental benefits for children and young adults covered by Medicaid. |

Veterans of the United States armed forces may be eligible for limited dental benefits. Patients with this coverage receive a claim form from the Veteran's Administration to give to the attending dentist, and the form includes all information necessary to assess benefits. Prior approval of treatment is usually necessary. United Concordia is the dental carrier that administers TRICARE for retired and active military personnel. Benefits vary depending on where services are rendered (in the continental US or outside the continental US).

Managed Care. Managed care is a method of providing low to moderate cost healthcare coverage to everyone. The premise is to provide everyone the opportunity to receive excellent care efficiently and cost-effectively compared to what is currently offered. With the increasing costs of medical and dental premiums affecting healthcare in general, managed care will be a source of conversation and negotiation. There are limitations to these plans such as type and level of care, and frequency of care sought. The level of reimbursement is also controlled in these plans. Plans such as capitation plans, DMOs, EPOs, IPAs, PPOs and closed panels are all considered managed care programs.

Insurance Carrier

An insurance carrier is an insurance company that agrees to pay benefits claimed under a dental plan. A single carrier may offer several different dental plans with a variety in deductibles, yearly maximums, reimbursement rates, and premiums. An insurance plan is an insurance contract that the carrier has written to provide specific benefits to those covered by the plan. Because insurance coverage is complex, the business assistant provides a service to the patient by helping her/him understand what benefits to expect. Plan information is found in the benefits booklet given to the subscriber. Much of this information is readily available from several insurance carriers by accessing the carrier's website or by requesting the information through an automated service via the telephone. Some carriers offer the service of faxing the requested benefit information to the dental practice.

Patient Information

Patient information includes data about the family dental plan. Patient information is obtained from the patient registration form and includes the following information:

| • | Full name (no nicknames) |

| • | Sex |

| • | Relationship to the insured (spouse, child, other) |

| • | Date of birth (month, day, year) |

The insured - or subscriber, is usually the family member who is earning the benefits.

The beneficiaries/dependents - those entitled to receive benefits under a health plan. This usually includes the insured, spouse and children. However, not all plans cover all family members. It is important to clarify on the patient registration forms which family members are covered and which are not.

The spouse - typically the wife or husband of the insured, although in some states and with certain dental carriers, individuals not legally bound are allowed to be included.

The children - for purposes defining dependent eligibility, a child dependent who does not exceed the age as designated in the contract. Most frequently, this age is 18 years. Coverage usually terminates when the child passes the designated age unless the child is still a full-time student or is permanently handicapped. In the case of a full-time student, the age limitation is usually 26 years. Some carriers allow part-time student status to be eligible for insurance benefits, while other carriers will cover the graduate during a "grace period" following graduation for 30 to 90 days, depending on the carrier.

This information must be complete and accurate because the insurance claim cannot be processed without it. If information is missing or incorrect, the claim will be rejected and returned for completion or correction, resulting in additional paperwork and payment delays.

Determining Eligibility

Insurance companies do not reimburse for services rendered to a patient who is not eligible to receive benefits. When an individual begins new employment, there is typically a waiting period of anywhere from 30 to 90 days before dental coverage becomes effective. If a subscriber has a change in job status, or changes employers, coverage under most plans is terminated within 30 days of the change. When an individual changes employers, is laid off or retires, the subscriber has the option of continuing coverage by continued payment of the premiums under the (COBRA) of 1985. This act allows the subscriber to continue the same coverage for up to eighteen months or until another coverage is in effect.

Eligibility rules for federal programs such as Medicaid and Medical Assistance vary greatly from state to state. Many dental patients assume that Medicare covers dental treatment - in most cases it does not. When working with patients enrolled in federal programs, one must be familiar with the specific form of identification required to determine eligibility. In most cases, this is an identification card or a proof of eligibility sticker. An individual's eligibility may change from month to month, and it is important that eligibility be verified at each visit. There are many dental practices nationwide that do not accept federally funded plans. It is important that the practice have a protocol in place for patients who claim eligibility under a federally funded plan, when they have already been seen for treatment.

Determining Dental Benefits

When an employer purchases a dental plan for its employees, it is the employer who negotiates the benefits and limitations of the plan. An employer may have several available options for employee coverage, and each plan should be thoroughly inspected before the employee chooses a plan. The insurance company (carrier) is responsible for covering only the level of treatment that is included in that particular plan. Explanations of all benefits and limitations are found in the benefits booklet provided to all subscribers. When benefits or limitations change, a new booklet is issued. Generally, new patients are requested to bring in a copy of this benefits booklet, so that coverage can be reviewed and discussed prior to treatment. Further, with subsequent patient visits, it is very helpful to view the patient's dental card and verify their current information in the computer system. Changes in plans and eligibility do occur, and a lot of time and unnecessary paperwork can be avoided if this becomes a regular practice of administrative team members.

There are two factors that determine how much the insurance company will pay and how much the patient must pay: (i) limitations within the plan, and (ii) the method of payment. Other factors also can influence the amount of benefit and resulting out-of-pocket costs.

Deductible. The deductible is the stipulated amount that the covered person must pay toward the cost of covered dental treatment before the benefits program goes into effect. Certain preventative procedures waive the deductible. There is a deductible amount defined per covered individual, with a maximum family deductible, per family, per coverage year. The following three examples demonstrate how the deductible works:

| • | The dental plan for the Anderson family has an individual deductible of $50 per year. Each year that amount of covered dental expenses must be paid by each family member covered under the plan before that family member is eligible for plan benefits. |

| • | The dental plan covering the Smythe family has an individual deductible of $25 per year or a family maximum of $75 per year. If the family of six has three members meeting the $25 deductible each, the deductibles will be waived for the additional three family members for that year. |

| • | The dental plan covering the Parker family has a deductible of $750 each year. Each year total covered dental expenses must reach $750 before plan benefits become effective. |

Co-insurance. Co-insurance, also known as a co-payment, is a provision of a program by which the beneficiary shares in the cost of covered expenses on a percentage basis. The amount that the patient is responsible for varies according to the policy. When calling for requested information, it is helpful to request a benefits breakdown, detailing the percentage covered in various treatment categories:

Preventative/Diagnostic - includes exams, preventative care such as radiographs, dental prophylaxis, sealants. Some carriers list space maintainers under this category as a preventative measure for children under the age of 16. Typically, the percentage covered is 100 percent.

Basic - restorative procedures such as amalgam filling, composite fillings. Percentage covered typically varies from 70 to 90 percent.

Major - crowns and bridges, inlays, onlays, dentures, partials, and at times, posterior composite restorations (depending upon carrier). Percentage covered typically varies from 30 to 60 percent.

Endodontic - endodontic procedures, sometimes listed under Major category. Percentage covered typically varies from 50 to 80 percent.

Oral Surgery - for some plans simple extractions may be listed under Basic category. Percentage covered typically varies from 50 to 80 percent.

Periodontics - periodontal procedures, sometimes listed under Major category. Percentage covered typically varies from 50 to 80 percent.

Orthodontics - may or may not be covered, depending on contract. Many plans have a lifetime maximum paid for orthodontic procedures that limit expenses to a certain amount covered for the patient no matter how long treatment takes.

Co-insurance percentages are usually listed showing the portion which the carrier will pay. To calculate the patient's amount due, subtract the portion covered by the insurance company from 100%. (see Table 2)

Exclusions. Some dental policies exclude certain dental services such as cosmetic dentistry, dentures and implants. This means that the insurance carrier will not pay for the service. The patient may still receive the treatment; however, the patient will be responsible for the entire fee. Dental policies may also exclude preexisting conditions such as missing teeth prior to enrollment in the dental plan. This is known as the missing tooth clause and the dental plan will not cover any procedure performed to fill that space, whether it is an implant, bridge or removable appliance.

Limitations of Frequency. Insurance policies may also have limitations on frequency for various services such as exams, prophylaxis, radiographs, fixed and removable prosthodontics, restorative replacements as well as preventative services such as sealants and fluoride applications. Some carriers are stringent with frequency dates, while others offer leeway by covering the service a set number of times during the contract year. Some of the more expensive procedures, such as dentures and crowns, may limit replacement coverage to five or more years, post initial placement under the same carrier.

Alternative Benefit Policy. When there is more than one treatment option available, the alternative benefit policy, also known as least-expensive alternate treatment (LEAT), is a limitation in a dental plan that allows benefits only for the least expensive treatment. For example, a patient wants a gold inlay on a posterior tooth while under the dental plan, however alternative benefits are paid for an amalgam restoration, which is the least expensive treatment for this situation. The patient would be responsible for the difference between the gold inlay fee and the reimbursement for the amalgam restoration.

Alternative benefit policy is widely used by many carriers when the procedure involves posterior composites. The composites are downgraded to an amalgam fee and the patient is responsible for paying the difference between the two fees. An alternative benefit policy is not a statement by the insurance carrier that one form of treatment is better than another. It is the carrier's way of controlling costs.

Dual Coverage. Some patients will have more than one dental plan, known as dual coverage. In these instances, it is important to take the required steps to make sure that the correct benefits are paid. Determination of primary and secondary carriers is needed.

Primary and Secondary Carriers/Coordination of Benefits. To make sure that patients receive maximum coverage not in excess of 100%, most insurance carriers provide for some form of coordination of benefits (COB), or dual coverage, for patients covered by two or more plans. Primary carriers pay first, and secondary carriers usually pay a portion of the balance. There are specific questions on the insurance claim form that need to be answered when a patient has dual coverage. When the patient is insured, his or her insurance is always the primary carrier (the first carrier to be billed) and the spouse's insurance is then the secondary carrier. After payment is received from the primary insurance company, a claim is sent to the secondary carrier if any balance is remaining. On an insurance claim form, the primary insurance information is always at the top right of the claim form. The secondary carrier information is listed in section 11-15 on the claim form. Many carriers have automatic coordination of benefits, and the primary carrier will forward the claim to the secondary carrier for payment of benefits. If there is not an automatic coordination of benefits, the following steps must be taken to submit the insurance claim forms properly:

| 1. | Submit the claim first to the primary carrier. |

| 2. | When payment is received, it will be accompanied by an explanation of benefits (EOB). |

| 3. | Send the claim to the secondary carrier, along with a copy of the EOB. |

When the patient has minor dependents and the spouse is also insured, the birthday rule is used to determine which insurance carrier will be the primary carrier for the minor when covered under both plans. The rule specifies that the parent whose birthday month and date falls earliest in the year is billed first, and only applies to parents not divorced. Note, this rule has nothing to do with which parent is older. For example, if Mrs. Olson's birthday is February and Mr. Olson's birthday is March, Mrs. Olson's carrier is primary in providing coverage for the Olson children and Mr. Olson's would become secondary.

Other factors come into play when the parents are divorced or when a step-parent is involved. It is important to work with these parents to determine proper sequencing of insurance billing and to clearly define the dental practice policies to the parent that accompanies the child patient.

Non-duplication of Benefits. Under insurance plans that call for non-duplication of benefits, a provision relieves the insurance company from the responsibility of paying for services that are covered under another program. This provision is sometimes called benefit less benefit. Under these types of plans, benefit reimbursement is restricted to a higher level permissible by the two dental plans rather than the total 100% of the charges.

For example, the treatment fee for a resin filling is $250. The primary carrier allows $160 and the secondary carrier allows $200. The secondary carrier in this case would only pay $40, which is the total amount of benefit minus the benefit amount already paid.

Total amount is $250

Primary allows $160

Secondary allows $200

$250 (total amount) minus $160 (primary coverage) equals $90

Secondary allows amount up to $200

(charge was $250)

$200-$160=$40

$90-$40=$50. Depending on how the plan reads, the patient may be responsible for the $50 or the dental practice may take a "write off" and adjust the difference.

Many patients are not aware of non-duplication of benefits clauses, which often produces misunderstanding regarding their benefits. It is vital to clarify this clause to your patients after any return of predetermination results from the carrier. When there is non-duplication of benefits, insurance carriers will rarely pay 100%.

Preparing Dental Claim Forms for Processing

As a courtesy to the dental patient, dental practices generally file dental claims with the insurance carrier. In order to file claims, the administrative team member must be familiar with the American Dental Association's (ADA) Code on Dental Procedures and Nomenclature. This is a list of number codes for all dental procedures and services possible within dentistry. These codes are published in the Current Dental Terminology (CDT) guidebook and are occasionally reviewed and revised to reflect changes in dental procedures that are recognized by organized dentistry and the dental community as a whole. Adjustments to the CDT (Code) book are published and effective biennially, at the start of odd-numbered years. Any claim submitted on a HIPAA standard electronic dental claim must use a dental procedure code from the version of the CDT in effect on the date of service. The CDT is also used on dental claims submitted on paper, and the ADA maintains a paper claim form whose data content mirrors the HIPAA standard electronic dental claim.

In the CDT code system, the first digit is the letter "D" throughout the series and identifies all procedures as being dental, as compared to medical, hospital, or surgical services. The second digit indicates the category of service. The third designates the class of a specific procedure, the fourth the subclass of the procedure, and the fifth digit has been provided for expansion of the code as required. If the treatment for a patient were a set of study models, the code D0470 would be defined as: D Dental 0 diagnostic service 4 tests or laboratory examination 70 diagnostic casts. It is essential for the administrative team to accurately and completely fill out a dental claim form, because forms that are not filled out correctly are returned to the dental practice for correction, slowing down the process of reimbursement for the practice. Files can be claimed by submission of a paper claim form, or by electronic transmission. Regardless of which way the claim is filed, the team member must be conscientious of the details and information being transmitted. (see Table 3)

There are additional codes known as SNODENT. These codes can be utilized for more involved treatments that also impact a patient's medical care and need special insurance coverage. These codes, often employed by oral surgery specialists, incorporate both medical and dental procedures.

Most practices will find that electronic insurance claim processing eliminates a lot of data entry, resulting in quicker claim filing and a reduced workload. In most dental software systems, the assistant enters the information only once and this information is carried throughout the system. Practice-specific codes can be entered into the computerized system and automatically converted to the proper ADA code for subsequent transaction processing and insurance submission. The ADA provides a standardized format for all claim forms. This ADA format may be generated electronically, as shown in Figure 6. With many computer management systems, the claim form is integrated into the system electronically. As modifications take place on the claim form, these changes can be made in the system.

The questions listed on the ADA form are common to the dental claim forms used by most dental practices.

Paper Claims. When a paper claim is submitted to the carrier, the data must be entered into the carrier's computer before it can be processed and paid. This handling of paper claims increases the carrier's cost of doing business and for this reason, carriers prefer to have claims submitted electronically. If a patient is to file the insurance claim, the completed claim form can be printed and given to the patient before leaving the dental office.

Electronic Claims Submission. As a service to patients and to facilitate claims management within the dental practice, it is important that all insurance claims be completed accurately and submitted properly. Electronic claims transmission eliminates the need for paper claim forms, delay in the mail, and the possibility for error as the claim form is entered into the carrier's computer. Filing electronically also speeds processing and claims can be paid more quickly, generally in 5 to 10 business days. Here is how electronic claims transmission works:

| • | Throughout the day, claim information is posted into the computer as treatment is completed. This process completes both bookkeeping and insurance records. |

| • | A copy of the claim may be printed for office files or retrieved at a later date from the computer system. |

| • | At the close of business, the claims are electronically checked for errors. For example, if a date of birth was omitted, this error would be flagged. |

| • | The corrected claims are electronically prepared and transmitted electronically either through a computer modem or the Internet. |

Dental practices can send their dental claim forms to many companies electronically in one of two ways. The first method is to send all the claims to a clearinghouse, where they are edited and returned to the dental practice if data is missing or is invalid. The clearinghouse then sends the claim forms to the appropriate payers or insurance carrier. If the carrier doesn't accept electronic claims, the claim is printed to paper and mailed to the carrier.

The newest system of claim form submission is through the Internet. In this method, the practice will enter the claims using a format that enables the form to go directly to the claims processing system. The advantages of using this electronic system are that the claim form arrives the same day that it was transmitted, any errors are more quickly detected, and payment reimbursement can be quicker. Most insurance companies are amending their policies on radiographic submission. Claims that require reports to be submitted can be done electronically, provided the remarks can be accommodated by the office software package. A report is generated listing which claims were successfully transmitted and which the system was unable to transmit. Any claim forms not transmitted, for any reason, must be prepared again and resubmitted.

There are two boxes on paper and electronic claims that require patient signatures: assignment of benefits and release of information. Assignment of benefits is a procedure by which the subscriber (patient) authorizes the carrier to make payments of allowable benefits directly to the dentist. When there is no assignment of benefits, the check then goes directly to the patient and it is the patient's responsibility to reimburse the dental practice. To assign benefits on a paper claim, the patient must sign on the line; for electronic claims, the box must be checked for assignment of benefits. Release of information regarding a patient's treatment may only be done with written consent of the patient, or legal guardian in the case of a minor.